Hsmb Advisory Llc Things To Know Before You Buy

Table of ContentsHsmb Advisory Llc Can Be Fun For EveryoneAll about Hsmb Advisory LlcHsmb Advisory Llc - TruthsHsmb Advisory Llc Things To Know Before You Get ThisThings about Hsmb Advisory LlcHsmb Advisory Llc Can Be Fun For EveryoneThe 7-Second Trick For Hsmb Advisory Llc

Additionally realize that some policies can be pricey, and having certain wellness problems when you apply can raise the premiums you're asked to pay. St Petersburg, FL Health Insurance. You will certainly need to make certain that you can pay for the costs as you will certainly need to dedicate to making these repayments if you want your life cover to continue to be in positionIf you really feel life insurance coverage might be advantageous for you, our partnership with LifeSearch permits you to get a quote from a variety of carriers in double quick time. There are different kinds of life insurance policy that intend to fulfill different defense needs, including degree term, lowering term and joint life cover.

The Main Principles Of Hsmb Advisory Llc

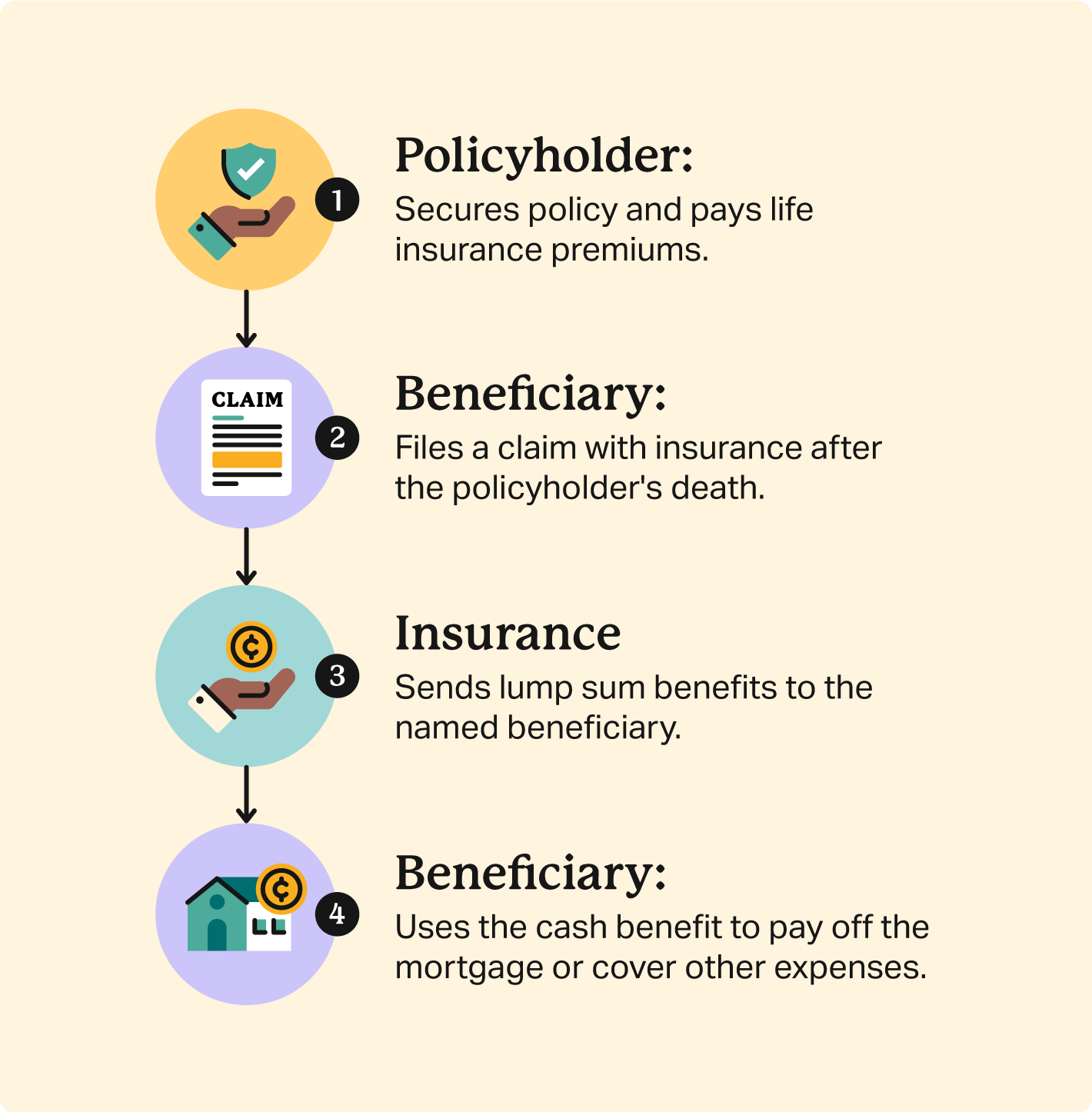

Life insurance policy gives 5 financial benefits for you and your family (Life Insurance). The major advantage of including life insurance policy to your monetary strategy is that if you pass away, your heirs get a lump sum, tax-free payout from the plan. They can use this money to pay your last expenditures and to change your earnings

Some policies pay if you create a chronic/terminal ailment and some give cost savings you can utilize to sustain your retirement. In this article, find out concerning the different benefits of life insurance policy and why it may be an excellent concept to buy it. Life insurance policy provides benefits while you're still active and when you pass away.

The Hsmb Advisory Llc Statements

If you have a plan (or policies) of that size, individuals that depend upon your revenue will still have cash to cover their continuous living costs. Beneficiaries can use plan advantages to cover important everyday costs like rent or mortgage repayments, energy bills, and grocery stores. Typical yearly expenditures for families in 2022 were $72,967, according to the Bureau of Labor Statistics.

More About Hsmb Advisory Llc

Additionally, the money value of whole life insurance coverage grows tax-deferred. As the cash worth constructs up over time, you can use it to cover costs, such as buying an auto or making a down repayment on a home.

If you make a decision to borrow against your cash money worth, the financing is not subject to revenue tax obligation as long as the policy is not surrendered. The insurance provider, nonetheless, will certainly charge rate of interest on the finance quantity until you pay it back (https://www.giantbomb.com/profile/hsmbadvisory/). Insurance policy companies have differing rate of interest on these loans

Examine This Report about Hsmb Advisory Llc

As an example, 8 out of 10 Millennials overstated the cost of life insurance coverage in a 2022 research study. In reality, the average price is better to $200 a year. If see here you think purchasing life insurance policy may be a clever economic relocation for you and your household, take into consideration seeking advice from a financial expert to adopt it into your economic plan.

The 5 major types of life insurance policy are term life, entire life, universal life, variable life, and final expenditure insurance coverage, likewise known as funeral insurance policy. Entire life starts out setting you back a lot more, yet can last your entire life if you keep paying the costs.

Getting My Hsmb Advisory Llc To Work

It can repay your financial obligations and medical expenses. Life insurance policy could likewise cover your home mortgage and give cash for your family members to keep paying their costs. If you have household depending upon your revenue, you likely require life insurance coverage to sustain them after you pass away. Stay-at-home moms and dads and local business owner likewise frequently require life insurance coverage.

Essentially, there are 2 kinds of life insurance policy intends - either term or irreversible strategies or some mix of both. Life insurance companies provide different forms of term strategies and traditional life policies as well as "passion delicate" products which have actually become extra widespread considering that the 1980's.

Term insurance coverage supplies security for a specified time period. This duration might be as short as one year or offer coverage for a certain variety of years such as 5, 10, two decades or to a defined age such as 80 or in some instances as much as the oldest age in the life insurance coverage mortality.

What Does Hsmb Advisory Llc Mean?

Currently term insurance prices are very competitive and among the most affordable historically skilled. It should be noted that it is a commonly held idea that term insurance is the least costly pure life insurance policy protection offered. One requires to examine the policy terms thoroughly to decide which term life alternatives are appropriate to fulfill your specific situations.

With each brand-new term the premium is increased. The right to renew the plan without proof of insurability is an important advantage to you. Or else, the risk you take is that your wellness might weaken and you may be incapable to acquire a policy at the exact same prices or perhaps in all, leaving you and your beneficiaries without insurance coverage.